Oil Prices Gain: Supply Constraints and Economic Prospects Hold Market Attention

Oil prices rose slightly early Wednesday, with the market focused on supply restrictions as winter approaches and the potential of a “soft landing” for the U.S. economy.

Brent Crude Rises

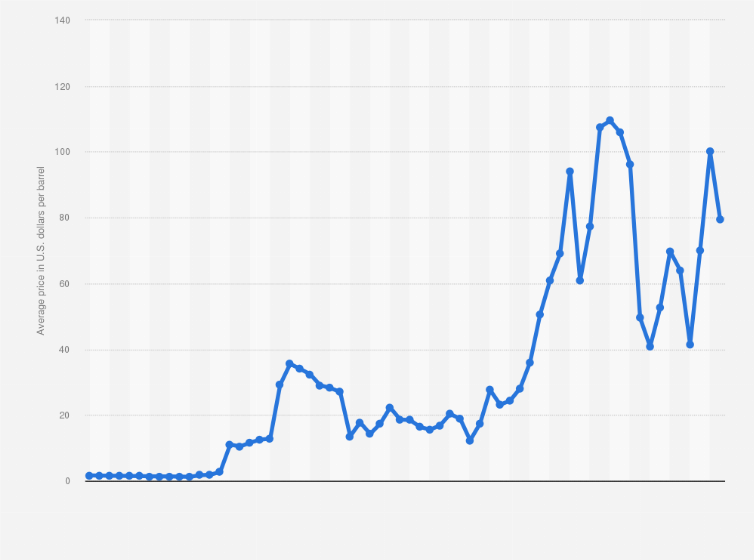

Futures for Brent crude oil increased 33 cents, or 0.4 percent, to $94.29 a barrel at 00:15 GMT. Futures for U.S. crude oil based on the West Texas Intermediate (WTI) benchmark increased 31 cents, or 0.3%, to $90.70.

Difference in U.S. Crude Oil Stockpile Data

The Tuesday before, industry data showed an unexpected increase in U.S. crude oil stocks of 1.6 million barrels. This contradicted industry analysts’ predictions of a 300,000-barrel drop.

However, U.S. crude reserves at Cushing, Oklahoma—the key storage hub—remain a concern. These stockpiles are dangerously near to the minimal operational threshold.

Further depletion of Cushing stockpiles, the delivery location for U.S. crude futures, might boost oil prices. This would increase supply limitations caused by OPEC+’s supply curtailments.

At 10:30 a.m. (1430 GMT), the United States will reveal its much-anticipated oil inventory statistics.

Oil Prices Gain: Seasonal Maintenance and Export Demand Balance

Some market observers expect refinery autumn maintenance to slightly increase oil stocks, while others worry that strong export demand would siphon barrels from domestic reserves.

Export Dynamics of Russia

Due to demand, Russia has reduced gasoline and diesel export limits. However, high-quality diesel and gasoline exports are still restricted. Products approved by Russian Railways and Transneft can be exported, however higher-sulfur gasoil and bunkering fuel are excluded.

U.S. Economic Outlook: “Soft Landing”

Minneapolis Federal Reserve Bank President Neel Kashkari provided economic thoughts. His prediction of a “soft landing” for the U.S. economy was growing. Kashkari also noted a 40% chance that the Federal Reserve may need to raise “meaningful” interest rates to combat inflation.

Kashkari predicted a quarter-point Fed rate hike. This would be followed by a period of stable borrowing costs. Restoring inflation to target in a reasonable timeframe is the goal.

The BoE’s Interest Rate Policy

Also linked to central banking, the Bank of England has finished tightening. A Reuters poll of experts predicts the Bank will keep the Bank Rate at 5.25 percent until July. A significant minority of economists believe rate rises may occur this year.

Oil Prices Gain: Interest Rate Effect on Oil Demand

High interest rates can raise borrowing costs, which can slow economic development and oil consumption.

US government funding measures

Finally, the Senate has advanced a bipartisan bill to prevent a five-day government shutdown. A Republican-backed proposal is also moving through the House. This sets the foundation for finance and government operations legislation, which affects energy and oil markets.